Personal debt to equity ratio calculator

It is a measure of. Simply enter in the companys total debt and total equity and click on the calculate button to.

Debt To Equity Ratio D E Formula And Calculator

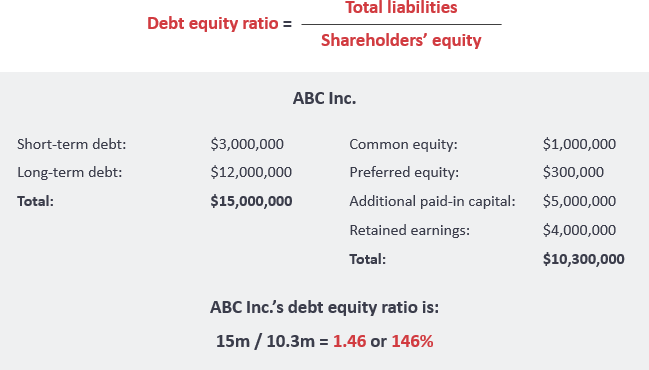

The Debt to Equity Ratio or Indebtedness as it is often known is a financial metric that indicates the relative proportion of liabilities and shareholder equity in the company.

. Ad Get access to alternative sources of income growth to complement traditional portfolios. This is the percentage of your gross income required to cover your housing and debt payments. Use this calculator to determine your debt to income ratio an important measure in determining your ability to get a loan.

How to Calculate Debt-to-Income Ratio. So the debt to equity of Youth Company is 025. Equitable Financial Life Insurance Company NY NY.

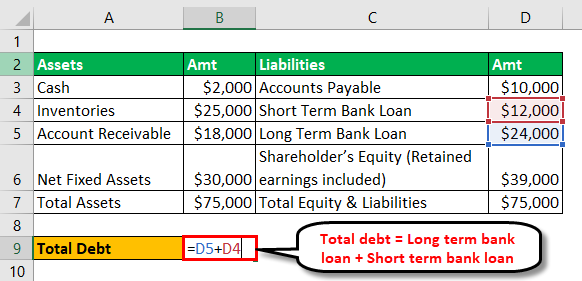

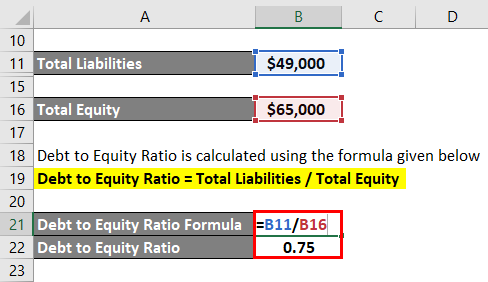

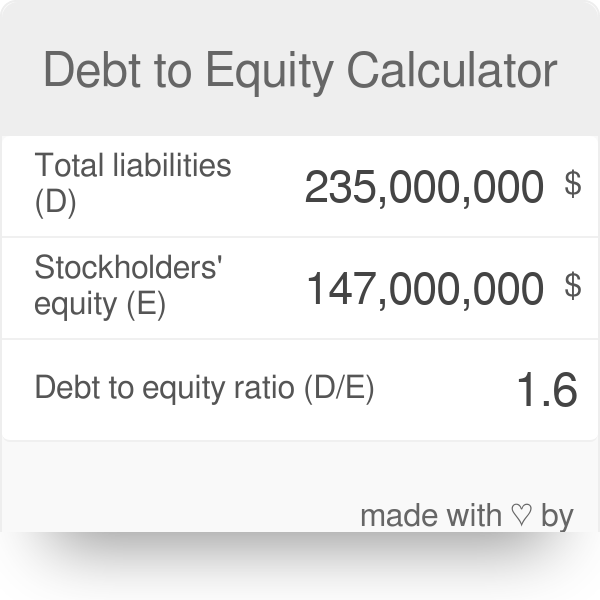

Therefore the debt to equity ratio of XYZ Ltd stood at 040 as on December 31 2018. A better way to look at whether your debt. Therefore the debt to equity ratio of the company is 075.

This is an online debt to equity ratio. No FICO Credit Check. Enjoy Low Personal Loan Rates.

To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Closely related to leveraging the ratio is. Enjoy Low Personal Loan Rates.

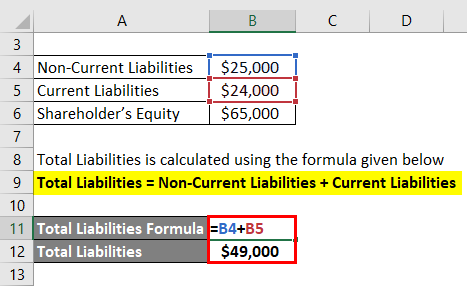

Our Resources Can Help You Decide Between Taxable Vs. The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly. A debt to equity ratio is simply total debt divided by total assets or equity.

If as per the balance sheet the total debt of a business is worth 50 million and the total equity is worth 120 million then debt-to-equity is. Use this calculator to quickly determine your debt-to-income ratio. The debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt used to finance a companys assets.

This is where the debt to equity ratio calculator can be a huge boon to your business. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Learn how a leading manager of alternative investments can help you manage wealth.

DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial. In the United States normally a DTI of 13 33 or less is. In the United States normally a DTI of 13 33 or less is.

Let us take the example of XYZ Ltd that has published its annual report recently. A 10 ratio or as little debt as possible is a great goal. For personal finances the ratio looks like this.

In a normal situation a ratio of 21 is. Build Your Future With a Firm that has 85 Years of Investment Experience. For example if your total assets equal 20000000 and the total of all your liabilities is 14000000 your debt to.

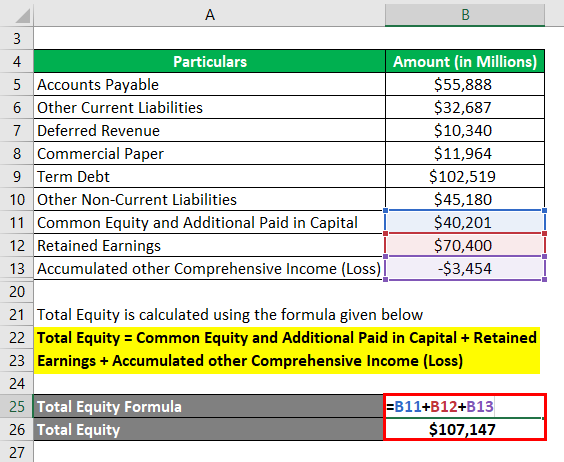

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Debt to Equity Ratio Formula Example 2. Ad Fast Simple Personal Loans Whenever you need them.

To calculate your debt-to-income ratio add up all your recurring monthly payments rent or mortgage payments home insurance taxes car payments credit card payments student. DebtEquity Total Personal Liabilities Total Personal Assets Liabilities If you take this number and multiply it by 100. The accessibility of a tool like this makes it an obvious contender over sitting down with pen and.

If a companys total liabilities are 10000000 and its shareholders equity is 8000000 the debt-to-equity. Ad Use LendingTrees Marketplace To Find The Best Home Equity Loan Option For You. Avoid high debt or consider a debt reduction plan.

To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan. Debt to Equity Ratio in Practice. Debt equity ratio Total liabilities Total shareholders equity 160000 640000 ¼ 025.

While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health. The debt-to-equity DE ratio shows the proportion of equity and debt a company is using to finance its assets. Information and interactive calculators are made available to you as.

Ad Our easy-to-use calculator can help see if you might qualify for debt relief. The lower your debt-to. Ad Secure The Money You Need Today.

Dont Settle For Just One Offer Compare Home Equity Rates And Find Your Lowest Instantly. Debt to Equity Ratio Total Liabilities Shareholders Equity. Ad Secure The Money You Need Today.

Talk to a Specialist Today. Get a Free Evaluation to Find the Best Solution for You. The DE ratio signals the extent to which shareholders equity can.

This is an online debt to equity ratio calculatorThe debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt used to finance a companys.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Leverage Ratios Formula Step By Step Calculation With Examples

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Calculator Formula

Debt To Equity Ratio Definition Formula Example

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Asset Ratio Calculator Bdc Ca

How Do You Calculate The Debt To Equity Ratio

Debt To Equity Ratio D E Formula And Calculator

Debt To Equity Ratio Calculator

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

How Do You Calculate The Debt To Equity Ratio

Debt To Equity Ratio Definition Formula Example

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt Ratio Formula And Calculator

How Do You Calculate The Debt To Equity Ratio

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It